Table of Content

Easy repayment options and quick processing further make these home loans more desirable. You may be familiar with the concept of a cosigner if you have student loans. If your credit isn’t good enough to qualify for the best personal loan interest rates, finding a cosigner with good credit could help you secure a lower interest rate. Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. To put it another way, the interest rate can change intermittently throughout the life of the loan, unlike fixed-rate mortgages. These loan types are best for those who expect to refinance or sell before the first or second adjustment.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. "Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far," says McBride.

Home Loan Providers

Today’s average rate on a 30-year, fixed-rate mortgage is 6.76%, which is 0.15% higher than last week. In a 52-week span, the lowest rate was 6.57% while the highest was 7.41%. TDSR refers to the portion of a borrower’s gross monthly income that goes towards repaying monthly debt obligations, including the loan being applied for. Here is “no escape” from local mortgage rates rising in tandem with US rising rates, noted Singcapital’s chief executive officer Alfred Chia. At today's average rate, you'll pay a combined $638.66 per month in principal and interest for every $100,000 you borrow. That's an increase of $6.59 over what you would have paid last week.

Use Bankrate’s mortgage rate calculator to calculate your monthly payments and see how much you’ll save by adding extra payments. The tool will also help you calculate how much interest you’ll fork up over the life of the loan. Before applying for a personal loan, it’s a good idea to shop around and compare offers from several different lenders to get the lowest rates. Online lenders typically offer the most competitive rates – and can be quicker to disburse your loan than a brick-and-mortar establishment. Borrowers with a 30-year fixed-rate jumbo mortgage with today’s interest rate of 6.82% will pay $653 per month in principal and interest per $100,000. That means that on a $750,000 loan, the monthly principal and interest payment would be around $4,904, and you’d pay around $1,013,797 in total interest over the life of the loan.

How can I improve my chances of getting a home loan with HDFC?

A loan EMI calculator or interest rate calculator is one and the same thing. This easy-to-use online calculator lets you calculate your EMI in no time. All you need to do is enter the relevant details related to your loan, including the loan amount, interest rate, loan tenure, and processing fee. This will be followed by an amortisation table giving you a comprehensive breakdown of your payment schedule. Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances.

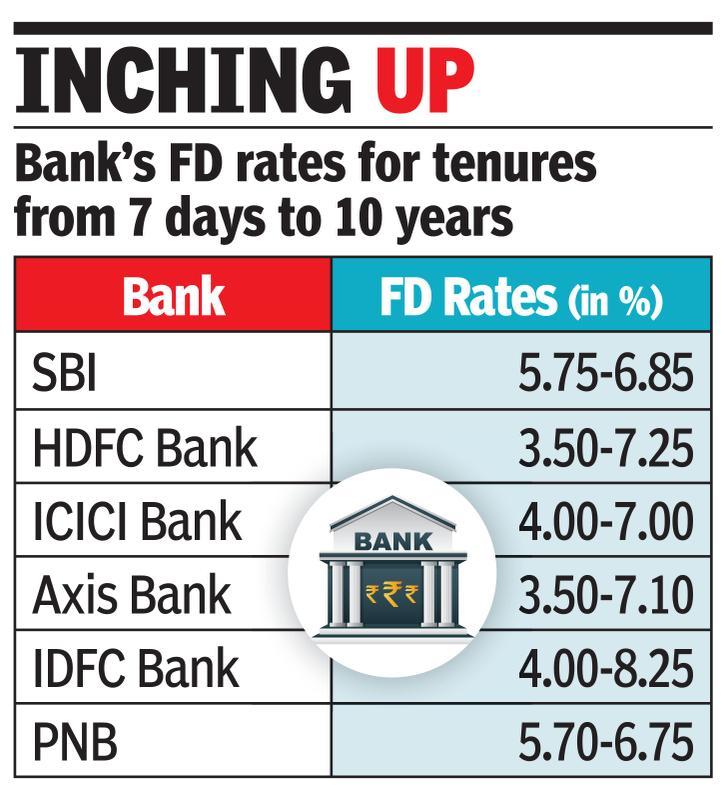

The fixed deposit advise of the deposit is available for immediate download by investors. With net advances of over Rs. 89,000 crores and a sizable deposit base of about Rs. 1,22,000 crore, the combined firm is now quite strong. The merged business will have a financial sheet of more than Rs. 1,63,000 crore. As a result of the merger, HDFC Bank now has a significantly larger branch network, customer base, geographic reach, and pool of trained labour.

Looking for a home loan?

Repayment is through EMI spread over a tenure of a maximum of 15 years. The loan is available to both the existing and new customers to undertake a gamut of upgrades, including internal and external. The monthly interest is directly credited to your bank account through ECS.

The detailed terms and conditions as stipulated by the financial service providers for their respective products shall be applicable. You should read the same in detail before concluding any transaction. Senior citizens, who are 60 years of age or older, are offered an additional 0.25% p.a.

Fixed Deposits

A government employee can apply for a home loan of either 34 times his basic pay or INR 25 lakh, whichever is less. The HDFC home loan interest rate changes on the first day of the calendar quarter i.e. at quarterly intervals along with the changes in RBI’s Repo Rate. Doesn’t matter whether you are salaried or self-employed, you can get this loan from HDFC Ltd. The interest rates are segregated according to the profession and gender of individuals across different loan amounts.

When you are ready to apply for a loan, you can reach out to a local mortgage broker or search online. In order to find the best home mortgage, you'll need to consider your goals and overall financial situation. The loan funds up to 80% of the residential home loan’s property cost, while 60% for non-residential home loans. Attractive interest rates with preferential rates for the woman customer in Standard and Tru-fixed patterns, depending on the loan amount.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Borrowers can compare the best home loan offers in Thiruvalla here, which helps in understand which bank is offer home loans @ lowest rates with lowest processing fees and fastest disbursal time. HDFC Home Loans provides low cost home loan interest rates for women. These rates are lower than those that apply to the regular customers. To avail of these concessional home loan interest rates, women have to be either an owner or a co-owner in the property for which the home loan is to be taken.

Also, borrowers who are salaried employees can also get reduced rates than those that have a business or are self-employed. Selecting a floating rate of interest for a home loan can make you switch to the new HDFC home loan interest rates. The interest rate on a INR 1 Crore HDFC home loan can range from 8.60% p.a. However, there are various other factors which are taken into consideration while determining the interest rate on a home loan application.

HDFC Bank has classified the home loan application based on the NRI’s location in the Middle East, United Kingdom, Singapore, and, finally, Other Countries. Reach Home Loan is designed exclusively for micro-entrepreneurs and salaried individuals lacking adequate income proof to apply for funds to acquire a dream house of their own. The scheme primarily benefits marginal businesspeople, skilled professionals, and artisans.

The prepayment charges are subject to change as per prevailing policies of HDFC and accordingly may vary from time to time which shall be notified on . The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. Improve your credit score by creating a reasonable track record of timely repayments so that you achieve a high credit score which would improve your prospects of getting a home loan. One can add a female co-applicant to the loan application to get concessional loan rates.

Adjustable Rate or Floating Rate

Loans for salaried individuals with a minimum monthly income of Rs.10,000 and for self-employed individuals with an income of Rs.2 lakh p.a. What this means is to arrange for a higher instalment amount to be transferred to your home loan servicing account, he explained. "HDB concessionary loan, which is pegged at 0.1 per cent above CPF Ordinary Account rates, will rise if OA rates rise. There is a high chance that this will have a slight increase," he added. Mr Wee said that based on current conditions, the three-month Singapore Overnight Rate Average is expected to reach 3.3 to 3.5 per cent in the first quarter of 2023. The latest change is unlikely to significantly impact the interest rate on mortgages, he added.

Interest rates on home loan are lower than other types of loans. The interest rate that you get on your home loan also depends on the LTV or the Loan to Value ratio. This means that the loan amount sanctioned by the bank is a ratio of the property value and the loan proceeds.

No comments:

Post a Comment